From gap to chasm and back again

How public services can help bridge Ontario’s widening income divide

Imagine if you will a line up of students standing shoulder to shoulder facing towards one end of an empty school gym. There are ten students in total. Each person represents an income decile—that is, ten per cent of income earners.

A teacher asks the students to walk forward one step for each thousand dollars in income their income category gained over the period of one decade, or backwards one step for each thousand dollars in income their income category lost over the same period. The extent of that change is shocking.

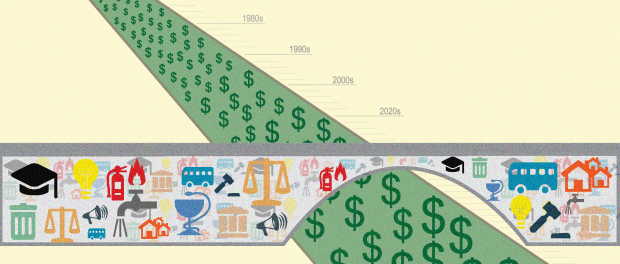

Let’s ask our imaginary students to start in 1980 and show us how income inequality has grown over the last generation. In the first decade, from 1980–1990, the highest income earner walks forward 21 steps. The next highest walks forward 13 steps. The third highest walks forward six steps. So far, so good. But then, the high-middle income earner walks forward just one step. The fifth person (a middle-income earner) actually walks backward one step. The next middle-income earner walks backward two and a half steps. The low-mid income earner walks backward three and a half steps. The lower income earner walks backward two steps. The lowest income earner inches forward one third of a step. (All figures are shown in Chart 1.)1

After only one decade we can see that our line up has fanned out quite dramatically. The top half have moved forward. Except for the lowest income earner, the bottom half have walked backward. But we are not done.

Let’s look at the next decade: from 1990–2000 the highest income earner walks forward a whopping 57 steps. They are almost at the end of the gym. The next highest income earner walks forward sic and a half steps. The third highest moves two and a half steps forward. The middle-income categories are stagnant, their incomes inching forward or backward, depicted by the students walking just one or two steps each. The lower income categories all mark losses: three and a half steps back, two steps back, and for those who have the least to lose in the lowest income category, a half step backward (more than erasing their small gain in the previous decade).

From 2000–2010 the fan spreads ever wider. We are now out of space in the gym. The highest income earners are so far gone they would be in another room. Again, the middle does not change much, forward a bit, back a bit. Lower incomes settle at their new lower levels.

In the final decade starting in 2010 we can measure up to 2017, the last year in which Statistics Canada data is available. Unbelievably, the highest income earners walk forward 33 steps more! From where they started, they have now walked more than 100 steps. The next highest are big winners too. They have moved forward 37 steps from the beginning of our exercise. The third highest are not doing poorly. They have walked forward sixteen and half steps. The high-middle income earner is also doing alright: six and a half steps forward. But everyone from the middle-income earners to the lowest income earners has lost ground.

The gap has stretched further than we can measure in a school gym. In truth it is no longer just a gap. It has become a chasm.

Shares of wealth reveal another dimension of inequality. “Wealth” is the value of assets accumulated by people: property, stocks, bonds, pensions, income funds, savings and the like, minus debts. It gives a sense of how much resilience people might have to weather a downturn in income.

In 2014 the Broadbent Institute surveyed Canadians’ perceptions about wealth disparity. They found that while Canadians believe that the gap between the richest and the poorest is growing, they underestimate significantly the breadth and depth of wealth inequality. In reality, the wealthiest fifth (twenty per cent) of Canadians own more than two-thirds of all the wealth in the country. The bottom twenty per cent own no wealth at all.2 The vast majority of Canadians, no matter which political party they supported, did not agree with such an inequitable distribution of affluence.

It is a bleak image indeed, but it does not have to be the case.

Ten years ago, economists Hugh Mackenzie and Richard Shillington set out to calculate the benefit of public services for each Canadian. What they found is that Canadians depend on public services such as education, health care, child care, public pensions, employment insurance and other services for their living standard. Their findings, translated into today’s dollars are impressive: the average per person benefit of public services in Canada is $21,135 and a median income household’s benefit from public services is $51,100 per year. More than two-thirds of Canadians’ benefit from public services actually equals the value of more than 50 per cent of their household’s total earned income.3 The bottom line? For two-thirds of us, the value of public services is like having a whole extra income earner in your house.

The Conference Board of Canada’s report commissioned by the Ontario Secondary School Teachers’ Federation, “The Economic Case for Investing in Education” takes it a step further. Looking at public education alone, from Kindergarten to Grade 12, the report calculates the multiplier effect of the almost 170,000 jobs and economic activity it creates. It then adds in cost savings from increasing the graduation rate resulting in better health, less need for social assistance and the criminal justice system. Each dollar of public education spending generates $1.30 in total economic impacts, like buying a house or shopping at a local store, contributing to the local economy and to provincial and federal coffers in taxes. Increasing resources for public education could lift high school graduation rates, they found, and save millions each year in health care, social assistance and criminal justice costs.4 (For more information read article “Investing in education—Investing in our future” Education Forum Fall 2019, Vol. 46, Issue 1, page 14.)

When Doug Ford ran for election, he criss-crossed Ontario visiting donut shops and the like, repeating promises for fiscal prudence with no lay offs, calming fears about privatization, appearing reasonable and measured. But under the radar Ford’s fiscal plan was uncompromising. Mike Moffatt is an economist at Western University. His comparative analysis of Ontario’s political parties’ fiscal (budget) plans were reported in one day of stories in the media and then the issue was dropped. But Professor Moffatt published his spreadsheets online for all to review5 and what he found is eye-popping. Doug Ford’s plan, laid out in his platform, was to cut provincial revenues by $22 billion in its first three to four years. Those revenues are the money used to fund our public services and social programs. In context, the Harris government of the 1990s cut $15 billion in today’s dollars in its first four years. Those were the deepest cuts to provincial revenues in our province’s history. They led to devastation of social programs and services. After Harris, from 2003–2006 the McGuinty government expanded public services. Then, when Dwight Duncan became finance minister, a new period of tax cuts for corporations began along with austerity budgets for public services. As the government struggled to pay for the corporate tax cuts, the 2008 financial crisis hit reducing revenues further and expanding the deficit. Real-dollar cuts and funding curtailment for public services were imposed. But nothing in our history has touched Doug Ford’s fiscal (budget) plan to cut more than $22 billion. If they are followed through, this would be the most radical slashing of the public sector in our province’s and our country’s history.

Though they have not reached $22 billion, already we can tally the extraordinary devastation of Ford’s cuts. The result is nothing like the election campaign promises: more than 700 green energy projects cancelled; environmental cuts from wind to tree-planting programs and flood management funds; real-dollar cuts to hospitals and long-term care; the axing of prescription drug coverage for youth 25 and under; cancellation of planned drug overdose prevention sites and the Hamilton LRT; elimination of funding for the College of Midwives; cuts to Public Health Units and mental health funding; the slashing of budgets for school repairs, legal aid, and financial assistance for college and university students; elimination of free tuition for low income students; the scrapping of three planned university campuses and the College of Trades; larger class sizes; mandatory online courses; cancellation of summer curriculum-writing programs for sign language and Indigenous languages; cuts to and restructuring of autism funding; downloading of costs for child care spaces. The list could go on and on.6

It is tragic that an entire generation has grown up hearing, almost unchallenged, the mantra that public service spending is out of control. In health care, public funding (which is the lowest in Canada and has been declining for decades) is treated like some kind of insatiable Pac-Man. We have been told repeatedly that health care is “eating up” the provincial budget. Journalists routinely query how we are to afford to meet basic needs even when faced with humanitarian crises. “But how are you proposing to bend the cost curve?” we are chastised. The media has bought into the premise of scarcity without any critical analysis. The status quo is untenable, we are told.

In truth the status quo is untenable. We cannot slash our way to prosperity. The fact that income and wealth are so skewed in favour of the wealthy; that almost half of the population of an entire generation now finds itself falling behind; that more and more the lottery of birth determines life chances as public services and supports are stripped away: these are among the most important issues of our times. We cannot let them go without challenge.

Our history shows that strong unions and citizens’ movements have been on the forefront of change that has improved the lives of Canadians: from the late 19th century’s push to end child labour and establish minimum wages; throughout the 20th century’s efforts to protect workers against death and disability on the job, to win pubic health care and establish public pensions; and more recently in the struggle for equal pay for women. The gains in income equality in the post-World War period were a result of a fundamental challenge to the old order that insisted on more democratic workplaces, public policies that served the public interests not solely private wealth, and importantly, the creation and expansion of public services that expanded life chances and bolstered families’ standards of living.

Earlier this year, teachers were on the frontline, striking against the cuts that the Ford government has implemented and proposed future cuts. Health care advocates and unions too have been rallying and protesting in the thousands, and through these actions all across Ontario we have successfully forced the government back on cuts to public health, long-term care, paramedic services, public hospitals and more. Collectively, our work shows that we can make a difference. Indeed, together we have changed history, and we have made tremendous progress toward the development of a just society often in bleaker circumstances than today’s. We can stem the rising tide of inequality. We are among the wealthiest people in the world at the wealthiest time in our history. Of course we can afford to take care of each other, if we only choose to.

Natalie Mehra is the Executive Director of the Ontario Health Coalition.

1 We should pause here to note that our straight line at the beginning should not be taken to mean there was ever complete income equality. There were high-income people and low-income people in 1980. Income shares have followed historic patterns of discrimination, with women, racialized people indigenous people and other marginalized groups disproportionately represented in the lower income categories, and this continues to be the case. But we can say, overall, from the post-World War period up until about 1980, the incomes distributed to Ontarians through salaries and wages and pensions were getting more equitable. After that the situation changed and it is this change that we are demonstrating.

2 Broadbent Institute, The Wealth Gap: Perceptions and Misconceptions in Canada, December 2014.

3 Mackenzie, Hugh and Shillington, Richard, Canada’s Quiet Bargain: The benefits of public spending Canadian Centre for Policy Alternatives, April 2009.

4 McArthur-Gupta, Aimee, The Economic Case for Investing in Education, The Conference Board of Canada, 2019.

5 Resource

6 Lists of the Ford government’s cuts see:

www.ontariohealthcoalition.ca/index.php/update-mounting-health-care-cuts

ofl.ca/power-of-many-ford-tracker-pc-cuts-and-privatization-to-date

www.nationalobserver.com/2019/06/07/news/heres-everything-doug-ford-government-cut-its-first-year-office

www.cbc.ca/news/canada/toronto/doug-ford-ontario-cuts-backtrack-1.5308060

www.broadbentinstitute.ca/5_ways_doug_ford_s_government_costs_us_more

www.macleans.ca/politics/tracking-the-doug-ford-cuts

Leave a comment